Product-as-a-Service Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

SAAS EXCEL DESCRIPTION

Product-as-a-service (PaaS), the circular / economic model that turns traditional / linear models on their head, has become wildly popular and is being utilized by companies such as HP and Xerox.

What is PaaS? The practice of selling the services and outcomes of a product rather than the products themselves, which traditionally would be produced, sold and then disposed of (by the buyer). As stated, PaaS is circular, i.e., products are returned to producers and given new life.

For example, a company may sell the "product" of clean clothes, i.e., a laundry cleaning subscription. While subscribed to this "product" (clean clothes), the customer pays a monthly fee and gains access to a washer, dryer, etc. Once the subscription/ service is ended, the washer and dryer are returned to the company which can then refurbish these products (if needed) and send them to another customer. It is sort of like a rental business model.

A buyer/ customer does not buy anything (in the physical sense) but rather acquires products that provide a service during the length of their subscription.

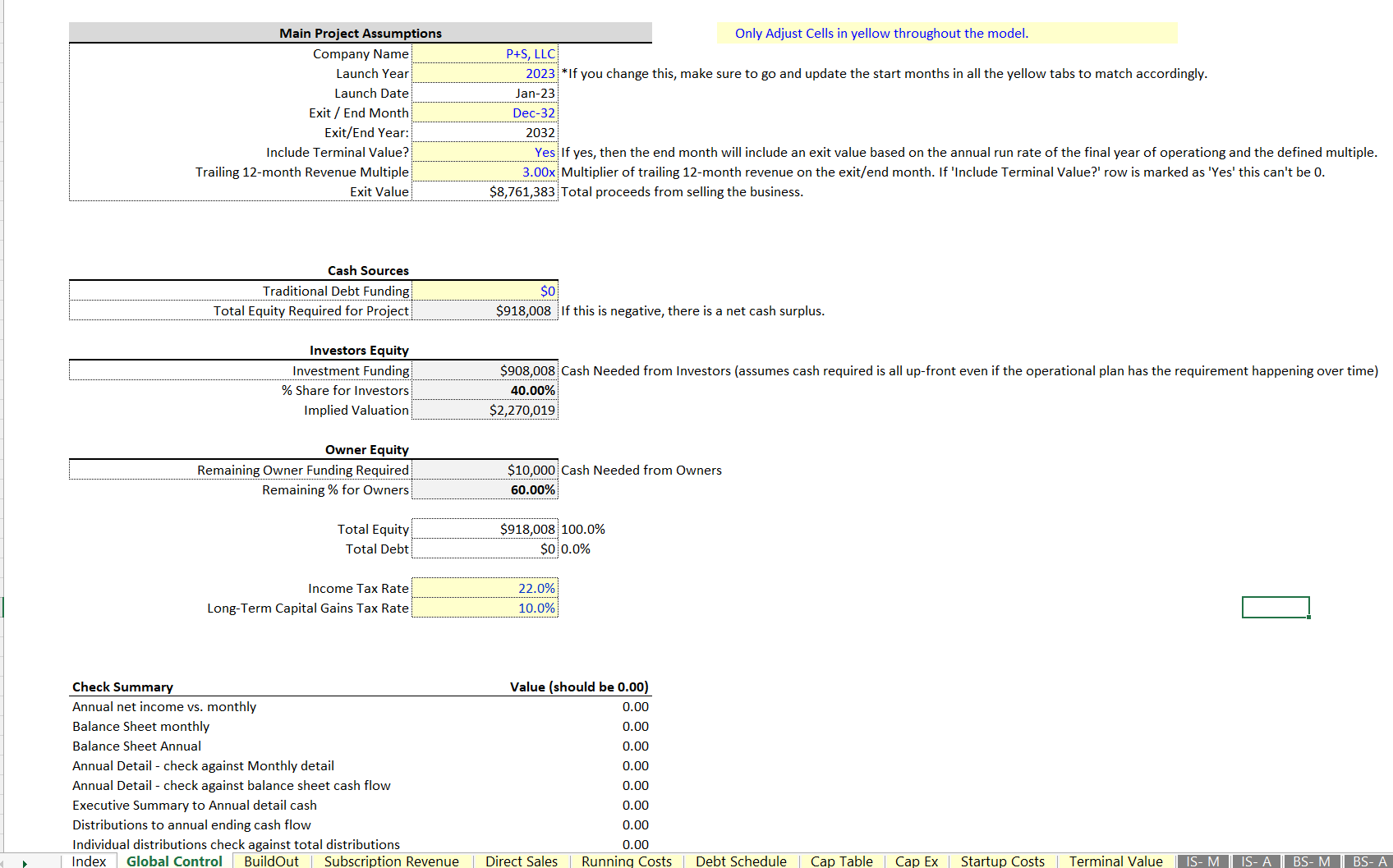

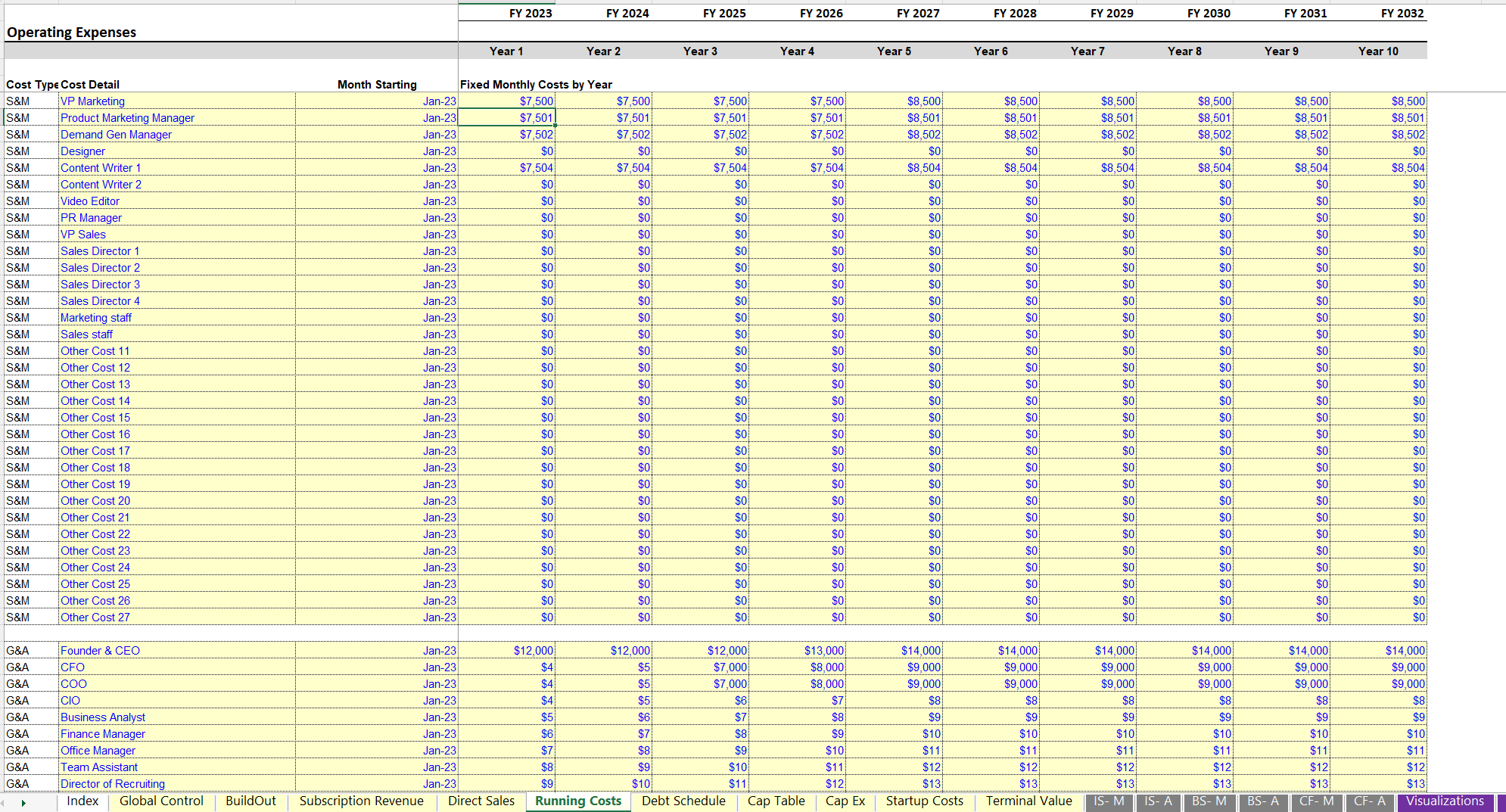

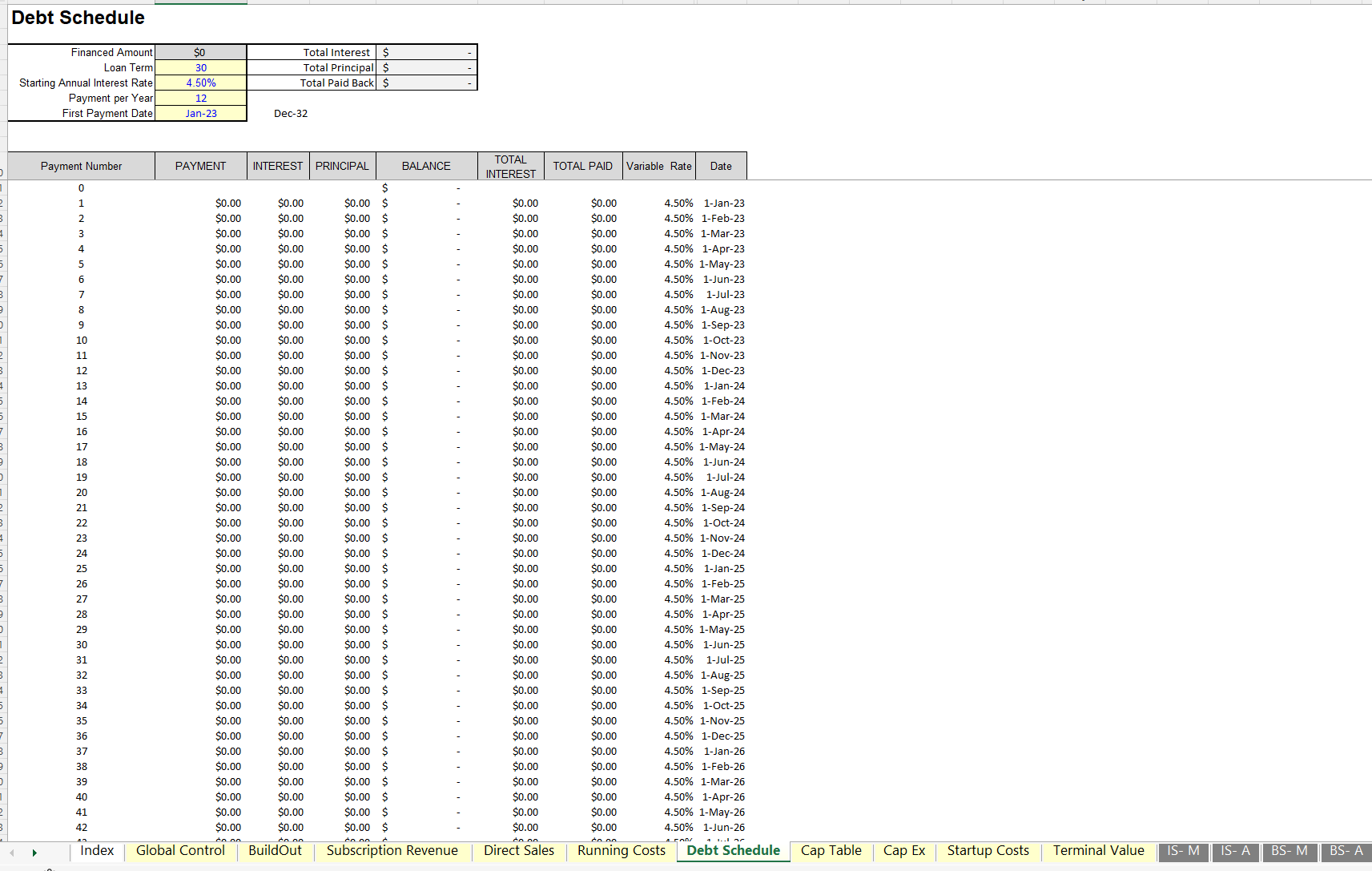

This financial tool was designed for individuals interested in starting a PaaS business. Created in Microsoft Excel, this tool is easy to use (with color coded input cells) and provides financial forecasting for up to ten years. Whether a user is testing various feasibilities or raising funds to start the endeavor, this model will be highly useful.

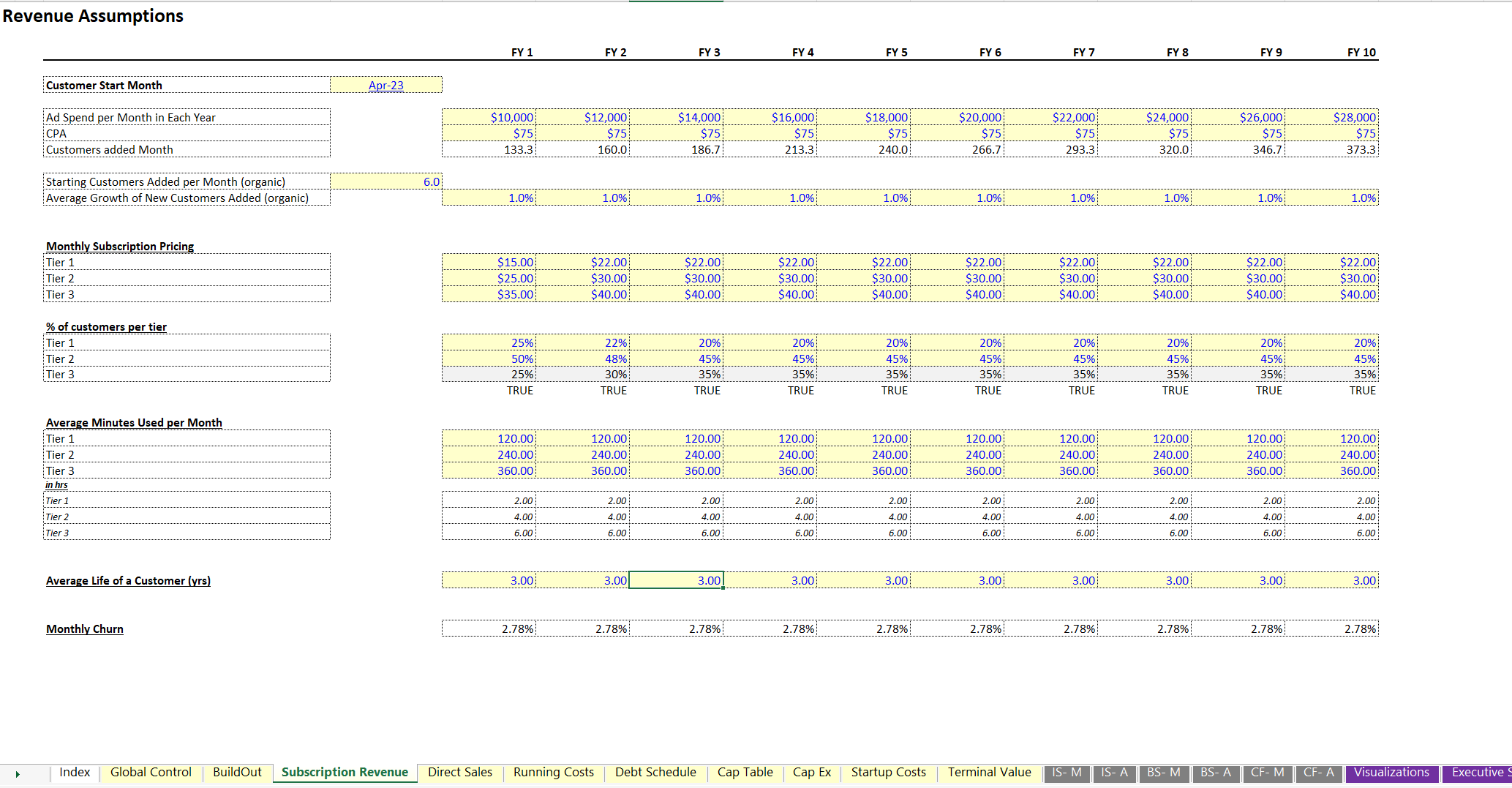

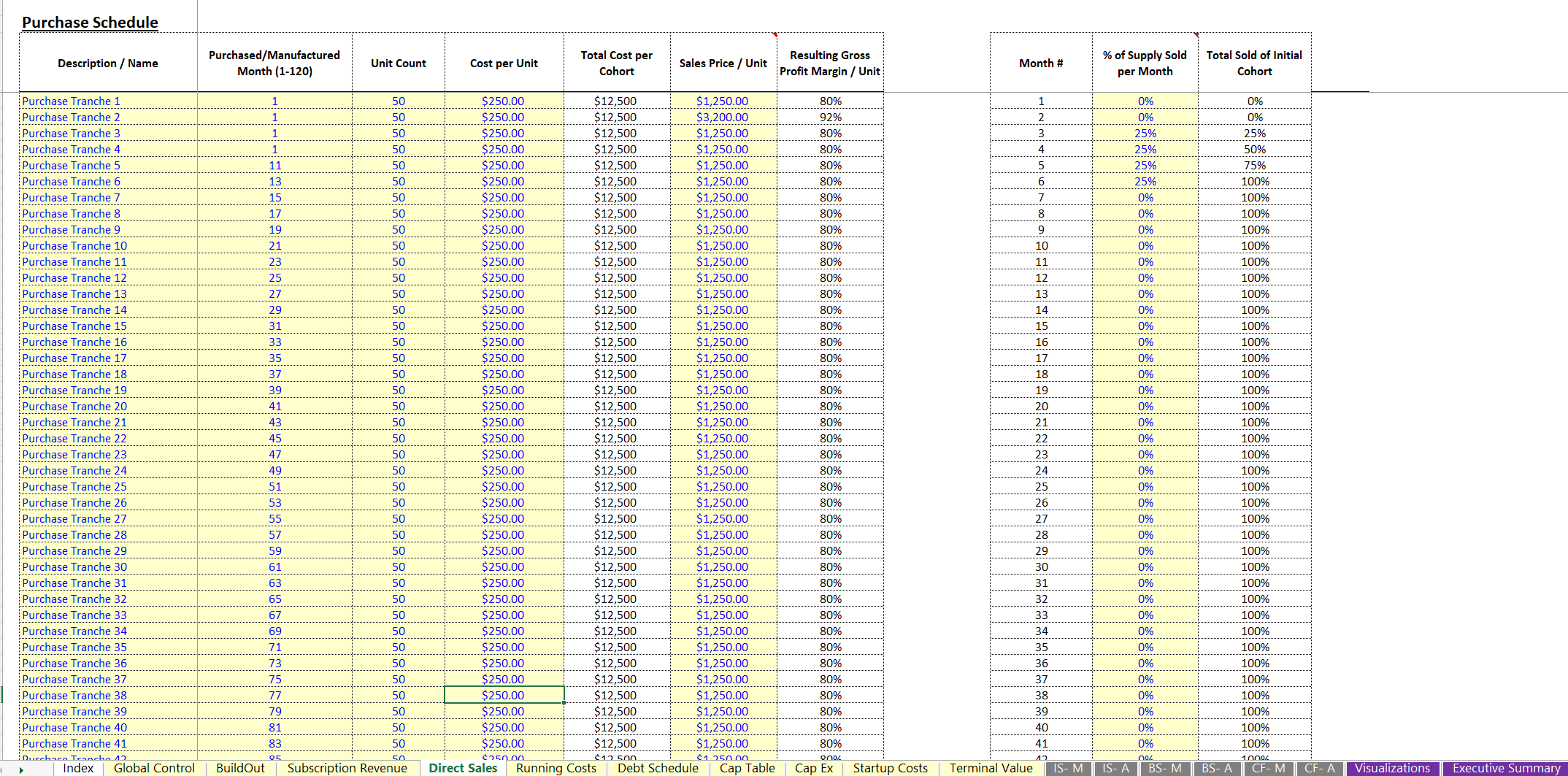

Many companies plan to do a combination of traditional/ direct sales and PaaS. This tool/ spreadsheet allows users to explore various feasibilities of direct sale only, PaaS only, or a combination of the two.

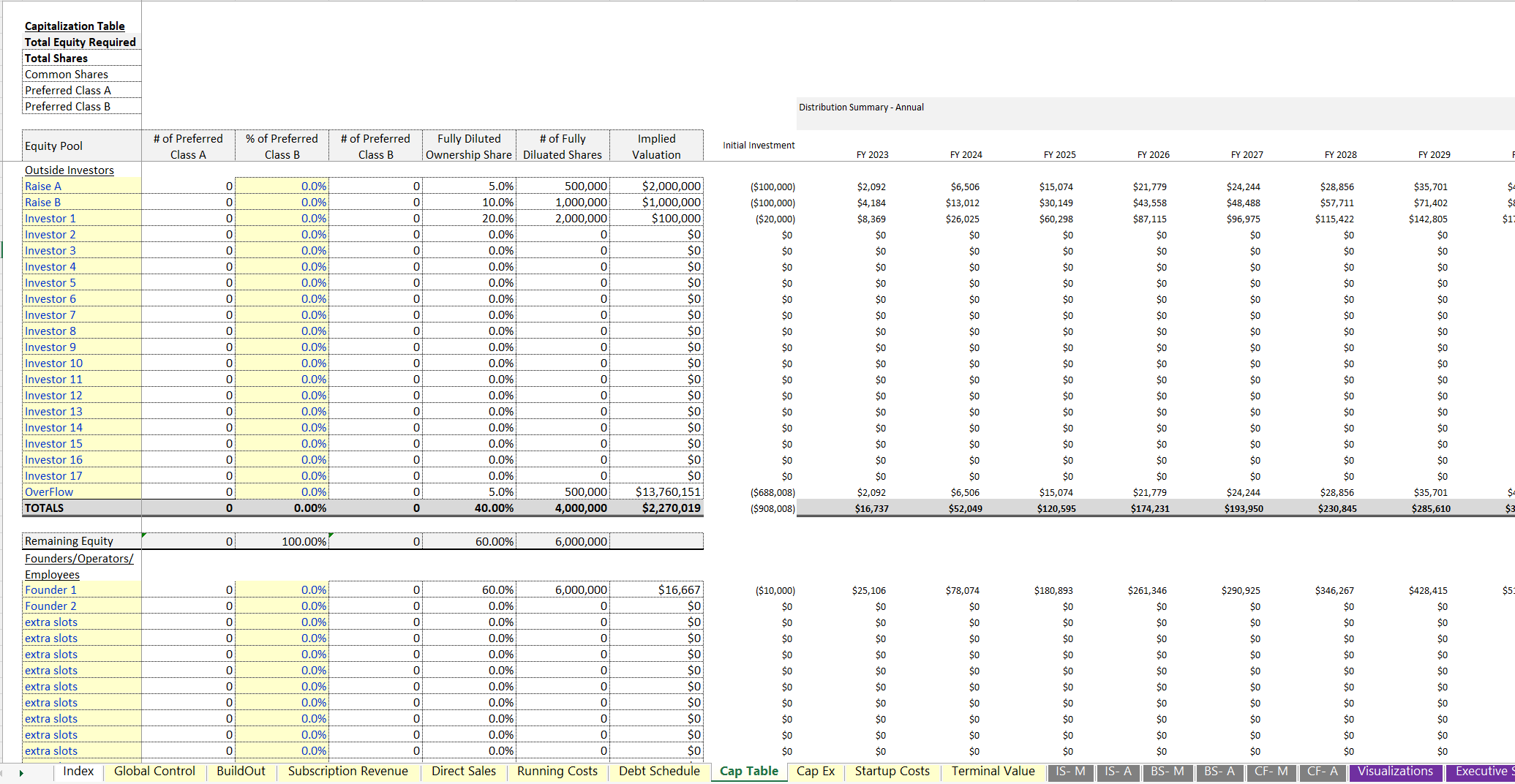

The primary function of the tool is to determine IRR of various scenarios, cash flow requirements, and how many products are required at various monthly subscriptions/ pricing levels.

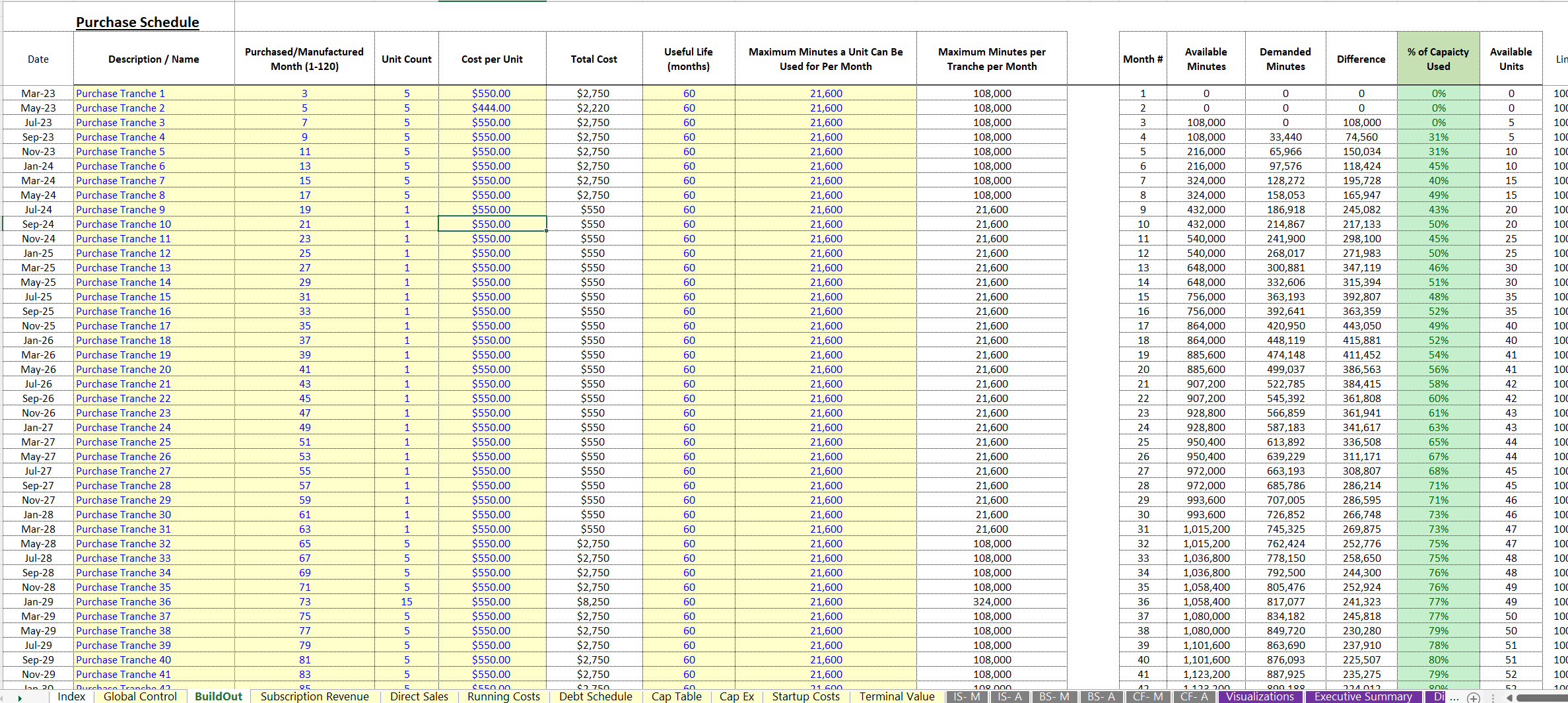

Users of PaaS will be concerned with depreciation of products versus cost of goods sold, which this tool accounts for.

Built in logic and user inputs generate: monthly/ annual cash flow statement, income statement, and balance sheet; monthly/ annual detail, e.g., results of: assumptions, sales, costs, customer tiers, cash flow, and EBITDA; key performance indicators, including LTV and CaC; annual executive summary; DCF analysis; general cap table/ IRR; and 12 visualizations (charts) which display various metrics.

Note, this 'product plus subscription addon' financial model is included in the purchase at no extra charge.

If you are assigning 1 product to 1 customer, simply set the capacity of a unit (measured in minutes) per month to the same as the customer usage per month and make sure your product deployment unit count matches customer count. This effectively creates a 1-to-1 dynamic and would be relevant if the products are actually shipped out to the customer rather than the customer having to access to product remotely.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in SaaS, Integrated Financial Model Excel: Product-as-a-Service Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Subscription-based Financial Models

This bundle contains 26 total documents. See all the documents to the right.